Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Blog Article

Everything about Mileagewise - Reconstructing Mileage Logs

Table of ContentsGetting My Mileagewise - Reconstructing Mileage Logs To WorkThe 9-Second Trick For Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To WorkAll About Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To WorkNot known Details About Mileagewise - Reconstructing Mileage Logs Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

Timeero's Shortest Range function recommends the quickest driving path to your employees' location. This function boosts productivity and adds to cost savings, making it a necessary asset for organizations with a mobile workforce.Such a strategy to reporting and conformity streamlines the typically complicated task of handling gas mileage costs. There are lots of advantages related to utilizing Timeero to keep track of mileage. Let's take an appearance at a few of the application's most significant functions. With a trusted mileage tracking tool, like Timeero there is no requirement to worry regarding inadvertently omitting a day or piece of information on timesheets when tax obligation time comes.

The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

With these tools in operation, there will be no under-the-radar detours to raise your reimbursement expenses. Timestamps can be discovered on each mileage entrance, increasing reputation. These extra verification procedures will maintain the internal revenue service from having a reason to object your gas mileage records. With accurate mileage tracking technology, your workers don't need to make rough gas mileage price quotes or perhaps stress over mileage cost tracking.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all vehicle costs. You will certainly need to proceed tracking gas mileage for job even if you're using the actual cost method. Keeping gas mileage records is the only way to different company and personal miles and supply the proof to the internal revenue service

The majority of gas mileage trackers let you log your trips manually while computing the range and reimbursement amounts for you. Many also featured real-time trip monitoring - you require to start the application at the beginning of your trip and stop it when you reach your final destination. These apps log your beginning and end addresses, and time stamps, along with the complete distance and reimbursement quantity.

Rumored Buzz on Mileagewise - Reconstructing Mileage Logs

Among the inquiries that The IRS states that car costs can be thought about as an "regular and needed" price in the training course of operating. This includes expenses such as gas, maintenance, insurance coverage, and the vehicle's depreciation. For these costs to be considered deductible, the lorry ought to be used for organization purposes.

Excitement About Mileagewise - Reconstructing Mileage Logs

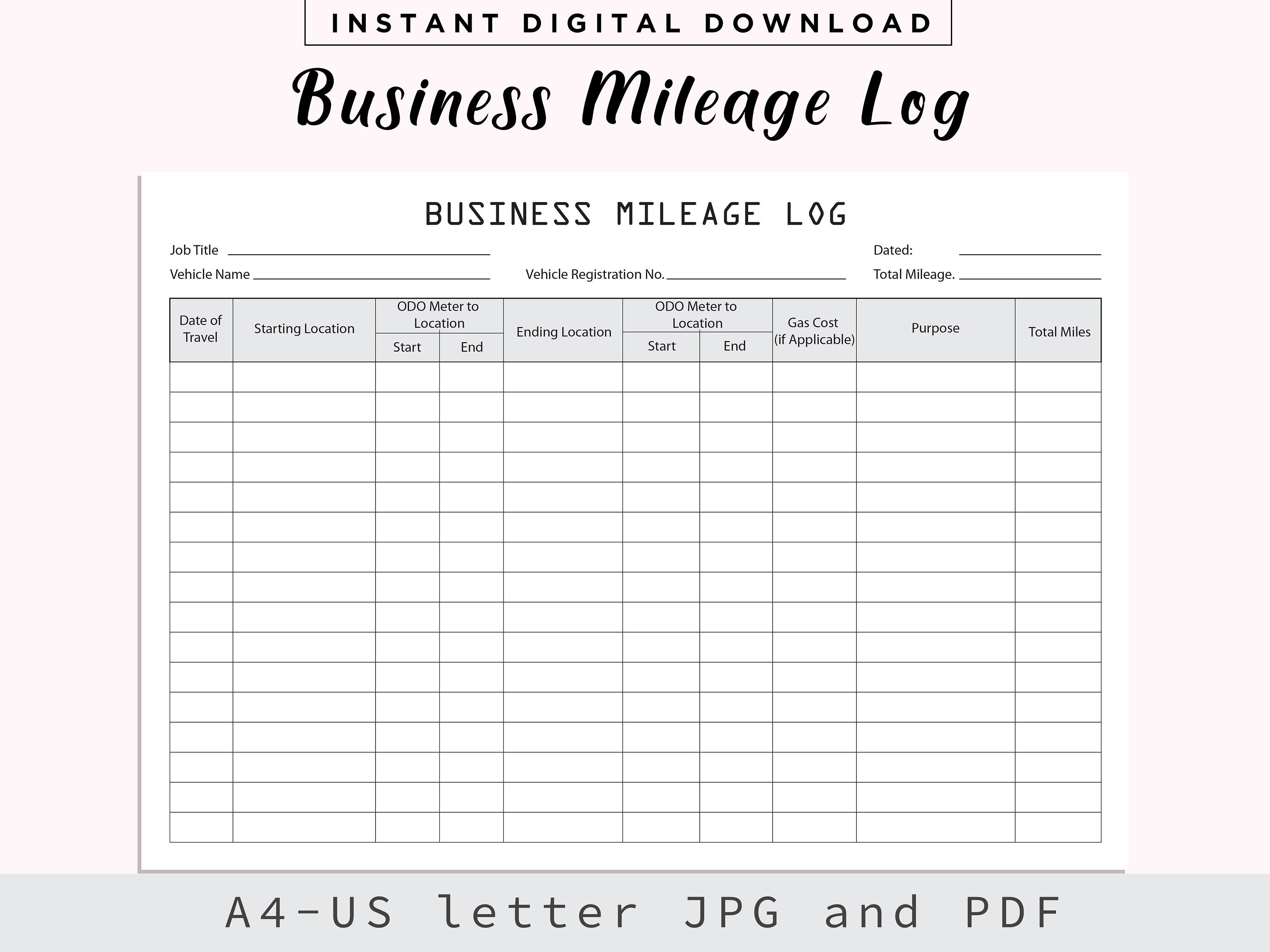

In between, faithfully track all your organization journeys keeping in mind down the starting and ending analyses. For each journey, record the location and organization function.

This includes the total service gas mileage and overall mileage buildup for the year (company + individual), trip's day, destination, and objective. It's important to videotape tasks quickly and maintain a synchronic driving log outlining date, miles driven, and organization objective. Here's exactly how you can boost record-keeping for audit purposes: Begin with guaranteeing a precise gas mileage log for all business-related travel.

Top Guidelines Of Mileagewise - Reconstructing Mileage Logs

The actual expenses approach is an alternate to the conventional gas mileage rate approach. As opposed to calculating your deduction based upon an established price per mile, the real costs technique allows you to subtract the actual costs related to utilizing your automobile for business functions - mileage tracker. These costs consist of gas, upkeep, repair work, insurance policy, depreciation, and other related expenditures

Those with significant vehicle-related expenditures or unique conditions may profit from the actual expenditures technique. Ultimately, your chosen technique needs to straighten with your details economic objectives and tax scenario.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

(https://telegra.ph/The-Ultimate-Guide-to-the-Best-Mileage-Tracker-App-for-Taxes-11-21)Determine your complete business miles by utilizing your begin and end odometer readings, and your recorded service miles. Properly tracking your precise mileage for service trips aids in confirming your tax deduction, specifically if you choose for the Criterion Gas mileage technique.

Maintaining track of your gas mileage manually can call for persistance, however bear in mind, it might conserve you money on your tax obligations. Record the complete gas mileage driven.

The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

And currently almost everyone utilizes General practitioners to obtain about. That he said means nearly everybody can be tracked as they go about their service.

Report this page